Table Of Content

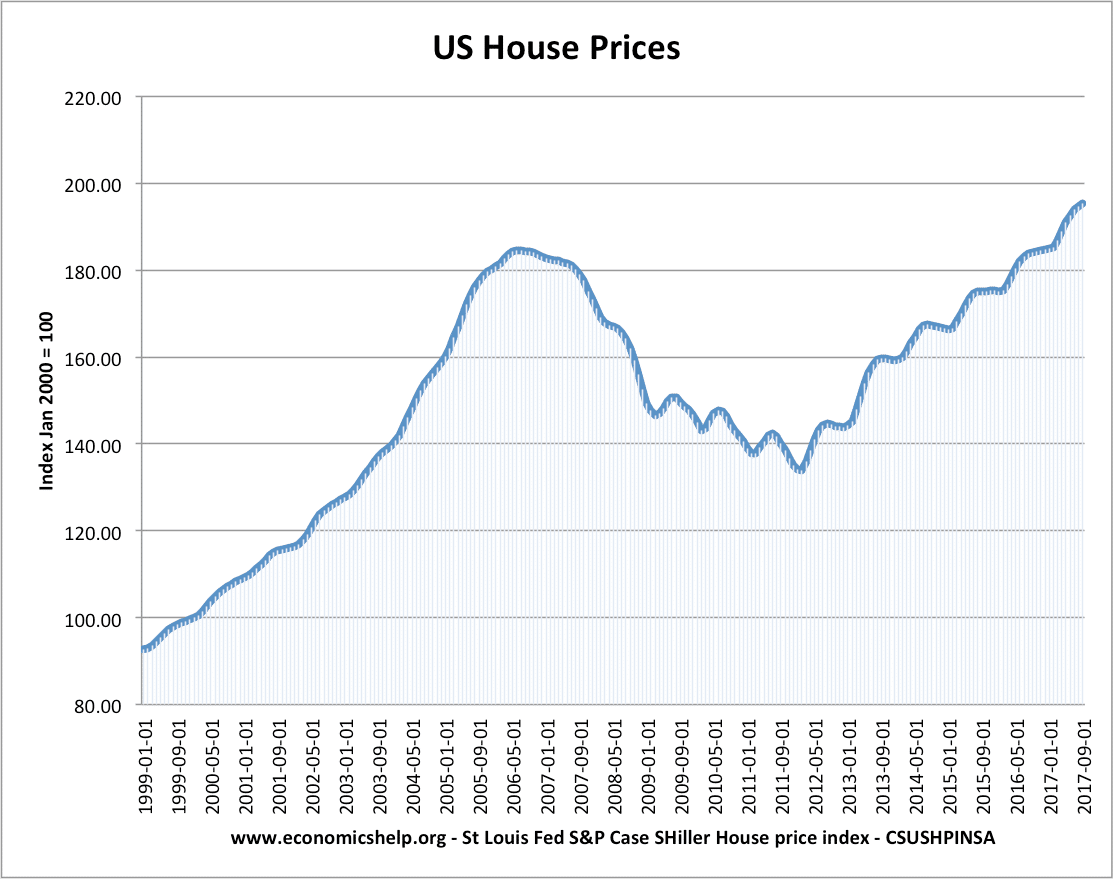

Foreclosures in the neighborhood would bring down prices as well as the increased likelihood of natural disasters in the area or a greater impact due to climate change. Even rising interest rates can bring down the value of a house, as the increase in mortgage rates makes homes more expensive, which reduces the demand. The rise and fall of house prices can have big implications for the economy. Price increases generally create more jobs, stimulate confidence, and prompt higher consumer spending.

Contact for Wales queries

UK monthly rent estimates for the latest two months and UK HPI estimates for the latest 12 months are provisional and subject to revision. All statistics are non-seasonally adjusted estimates, unless explicitly stated otherwise. The national HPI is constructed in an analogous fashion, except that the weighted components are census divisions. Because the census divisions measures are themselves weighted averages of state metrics, the U.S. index is equivalent to a state-weighted metric. How do I use the manipulatable data (in TXT files) on the website to calculate appreciation rates?

Annual Report to Congress

The House Price Index (HPI) is an economic indicator that tracks changes in home prices across the United States. Given its connection with the U.S. government, Freddie Mac can borrow money at interest rates that are generally lower than those available to other financial institutions. It purchases, guarantees, and securitizes mortgages to form mortgage-backed securities (MBS).

Private rent prices for local areas

While we make efforts to account for this volatility, the change in price in these local levels can be influenced by the type and number of properties sold in any given period. Low numbers of sales transactions in some local authorities can lead to volatility in the series. Estimates for the most recent months are provisional and are likely to be updated as more data is incorporated into the index. The full UK House Price Index report and monthly data are published by HM Land Registry. In India, National Housing Bank completely owned by Reserve Bank of India computes an index termed NHB RESIDEX. The index was formulated based on a pilot study covering 5 cities, Delhi, Mumbai, Kolkata, Bangalore and Bhopal representing the five regions of the country.

Historical Data

To produce provisional UK statistics, Great Britain's inflation rate for the latest two months has been used to estimate Northern Ireland's inflation rate in this period. Average private rent in Northern Ireland increased by 10.1% in the 12 months to January 2024, up from 9.3% in December 2023. Average private rent for Scotland was £947 in March 2024, up 10.5% (£90) from a year earlier. Scotland's annual inflation rate has been generally slowing since the record-high annual rise of 11.8% in August 2023, which was the highest annual rise since this series began in 2012.

Case-Shiller: National House Price Index Up 6.0% year-over-year in January - Calculated Risk

Case-Shiller: National House Price Index Up 6.0% year-over-year in January.

Posted: Tue, 26 Mar 2024 07:00:00 GMT [source]

Repossession sales volume

We are investigating the feasibility of extending the time-series back further. Because of differences in data collection and housing policy, caution is advised when comparing Scotland's estimates with other areas in England and Wales and within Scotland. More information is available in our PIPR Quality and Methodology Information (QMI).

No one knows for sure what future dividends are going to be, or what discount rates investors will require on assets. Despite this obstacle, analysts still find it helpful to construct measures of fundamental value for comparison to actual valuations. One popular measure is the price-dividend ratio, which corresponds to a price-rent ratio for houses. The House Price Index measures the movement of single-family home prices in the United States. It is reported monthly and measures the change from the previous month and year-over-year. It is an important economic indicator, shedding light on the state of the economy and housing affordability.

Change in FHFA State House Price Indexes (Seasonally Adjusted, Purchase-Only Index, 2023Q

We aim to include Northern Ireland in the Price Index of Private Rents (PIPR) in March 2025. Average private rent for Wales was £727 in March 2024, up 9.0% (£60) from a year earlier. This annual rise was unchanged from the 12 months to February 2024, but remains below Wales's record-high annual rise of 9.8% in November 2023, which was the highest annual rise since this series began in 2010.

The ASCII data for metropolitan areas are normalized to the first quarter of 1995. The purchase-only indexes are normalized to 100 in the first quarter of 1991. FHFA does not publish a repeat purchase index for the 11 metropolitan areas comprised of metropolitan divisions. Therefore, we estimate a repeat purchase index for these areas (RHOFHOPIQ). This series is an average of the repeat purchase index in each component metro division, weighted by home sales in corresponding areas.

Legislation enacted in February 2008 has raised the limit on a temporary basis to as much as $729,750 in high cost areas in the continental United States. Conventional means that the mortgages are neither insured nor guaranteed by the FHA, VA, or other federal government entities. The FHFA HPI is a broad measure of the movement of single-family house prices. The FHFA HPI is a weighted, repeat-sales index, meaning that it measures average price changes in repeat sales or refinancings on the same properties. This information is obtained by reviewing repeat mortgage transactions on single-family properties whose mortgages have been purchased or securitized by Fannie Mae or Freddie Mac since January 1975.

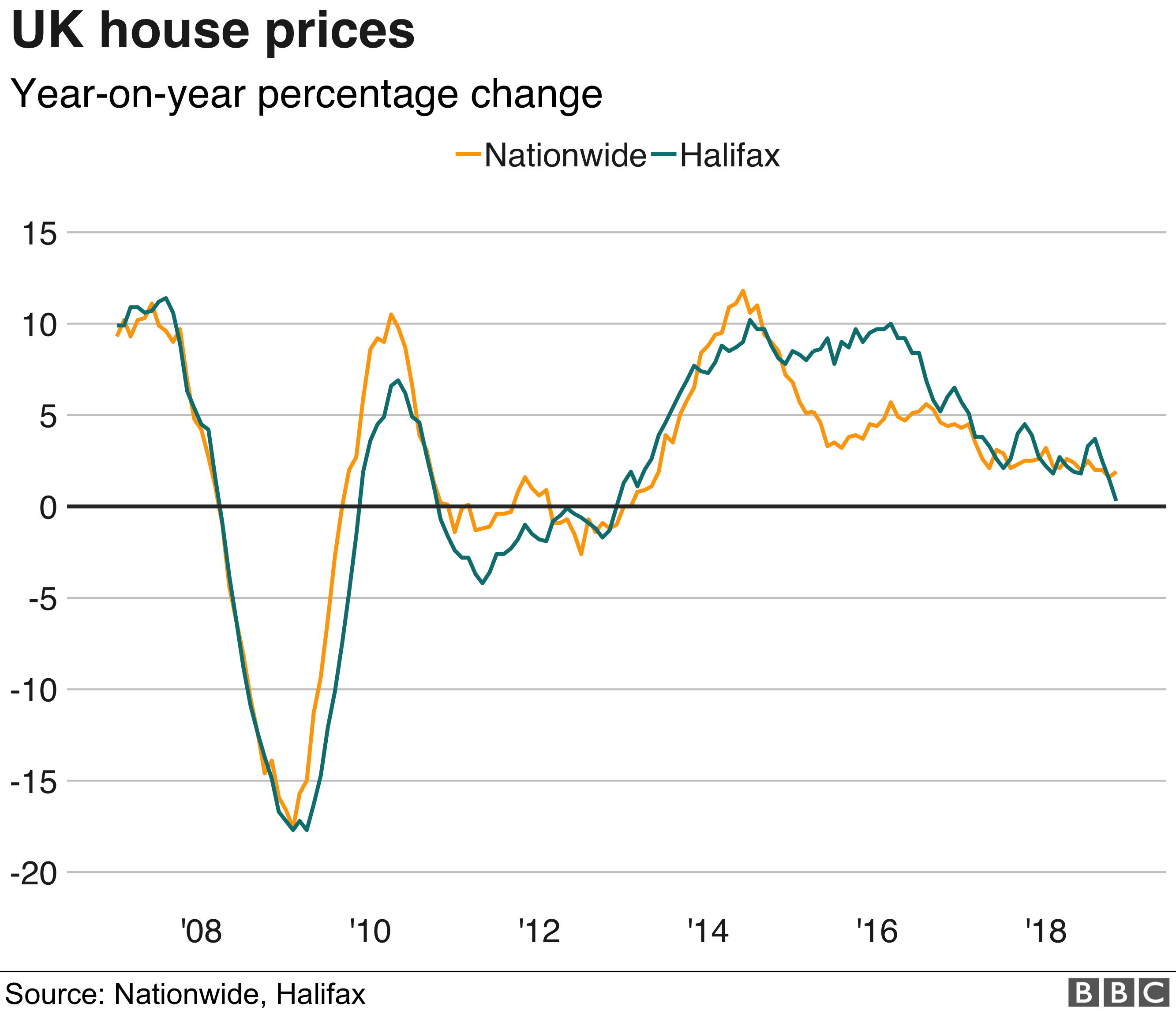

Average UK house prices decreased 0.2% (provisional estimate) in the 12 months to February 2024, to £281,000. This was up from a decrease of 1.3% in the 12 months to January 2024 (revised estimate). Price Index of Private Rents (PIPR) measures private rent inflation for new and existing tenancies. The US Federal Housing Finance Agency (formerly Office of Federal Housing Enterprise Oversight, a.k.a. OFHEO) publishes the HPI index, a broad quarterly measure of the movement of single-family house prices.

The index numbers alone (for census divisions and U.S., individual states, and MSAs) do not have significance. They have meaning in relation to previous or future index numbers, because you can use them to calculate appreciation rates using the formula below. A bubble occurs—in either the stock market or the housing market—when the current price of an asset deviates from its fundamental value. Right away we see that bubbles are difficult to detect because fundamental value is fundamentally unobservable.

Beginning in March 2008, OFHEO (one of FHFA’s predecessor agencies) began publishing monthly indexes for census divisions and the U.S. The House Price Index, as developed by the Federal Housing Finance Agency (FHFA), is a barometer for measuring the movement of single-family house prices in the U.S. It provides a macro-level understanding of the housing market’s current state and potential future trends. As noted above, the HPI measures average price changes for homes that are sold or refinanced by looking at mortgages purchased or secured by Fannie Mae or Freddie Mac. That means loans and mortgages from other sources, such as the United States Department of Veterans Affairs and the Federal Housing Administration (FHA), do not feature in its data.

No comments:

Post a Comment